Content

Interest rate risk is only one component, but it can be an important item to pay attention to when managing your portfolio and creating a long-term strategy. You may want to consider sectors that tend to perform best (or fall in price the least) when the market takes a downward turn. The sectors that have historically performed best—and worst—vis-à-vis the broader market in the year following the first in a new cycle of rate hikes. Manufacturers and sellers of kitchen appliances, cars, clothes, hotels, restaurants, and movies also benefit from the economic health dividend. Companies to keep an eye on during interest rate increases include appliance maker Whirlpool Corp. and retailers Kohl’s Corp., Costco Wholesale Corp., and Home Depot, Inc. Raising interest rates leads to higher borrowing costs, which can lead to a slowdown of growth, which in turn helps to control inflation.

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Our investing reporters and editors focus on the points consumers care about most — how to get started, the best brokers, types of investment accounts, how to choose investments and more — so you can feel confident when investing your money. The sector hasn’t performed horribly since the Fed started hiking rates. But lower interest rates in the future might also coincide with the sector’s push for renewables. That could make a boring stock category like utilities into an exciting growth opportunity. But it also includes lesser-known companies like Monolithic Power Systems, which has a debt-to-equity ratio of zero.

The Vanguard Value ETF tracks the performance of the CRSP US Large Cap Value Index, a collection of big companies trading at relative discounts. With a rock-bottom expense ratio, a strong long-term record and about 20 percent exposure to financials, this fund should perform well in a rising-rate environment. Bancorp Investments and is not intended to be a forecast of future events or guarantee of future results. It is not intended to provide specific investment advice and should not be construed as an offering of securities or recommendation to invest.

Also, a low expense ratio won’t take away much of your returns, which averaged more than 12 percent annually over the last decade. The Federal Reserve has furiously raised interest rates throughout 2022 and into 2023 as it tries to rein in high inflation. After going through much of 2020 and 2021 in a zero-rate environment, investors got comfy with a very accommodative Fed, which floored the gas pedal to help the economy through the pandemic.

There is no guarantee any ProShares ETF will achieve its investment objective. If higher interest rates translate into lower values in an insurer’s investment portfolio, then capital loss limitations could become significant at some point in the future. But, even though investment markets have been turbulent lately, equities have yet to experience a truly significant decline and existing discounts on bonds generally will expire if the bonds are held to maturity. Rising rates typically result in a cooling of the reinsurance transaction market because insurers have less need to reinsure or transfer interest rate risks to other parties.

Look for Opportunities to Earn Higher Interest Rates on Your Savings and Cash Reserves

It’s easy to be anxious since many benchmarks like the S&P 500 and industries like the once red-hot cryptocurrency market have realized double-digit-plus losses. If you do make adjustments to your sector allocations, consider keeping them small—no more than a few percentage points. The market expects the Fed to raise rates at each of the remaining policy-setting meetings in 2022 and anticipates additional hikes1 by the end of 2023—which suggests stocks may be in for a bumpy ride, at least in the near term. In March, the Federal Reserve set into motion a cycle of rate hikes that could last well into 2023. That’s bad news for borrowers—but could be good news for sectors that historically have benefited from higher interest rates. However, the different branches that make up the industry are very heterogeneous.

Although minimum coverage is legally mandated in many cases for individuals and businesses, restitution shortfalls and correspondingly aggrieved policyholders can become problematic for carriers. In such an environment, prescient insurers will review product structure and features with underwriting and brokers to ensure coverages are adequate and go beyond legally required minimums. With the change in control of both houses of Congress as well as the executive branch, another potentially inflationary element has been added to the policy mix—aggressively expansionary fiscal policy.

A bank with a low deposit beta may be a core banking franchise that has a lot of checking accounts relative to savings accounts or certificates of deposit. That’s because people seek out a high interest rate on savings, while checking accounts usually pay nothing or almost nothing. But high inflation can still be especially harmful for banks because it erodes the present value of existing loans that will be paid back in the future. Our research has found that equities outperformed inflation 90% of the time when inflation was low (below 3% on average) and rising.

“Value stocks tend to be better immediate cash flow generators that can take advantage of money earned now versus in the future,” he added. It’s important to remember that no investment strategy is foolproof, and it’s always important to carefully evaluate each investment opportunity before making any decisions. By understanding which sectors tend to perform well in a rising interest rate environment, however, investors can potentially profit from this trend and build a more resilient portfolio. Regardless of the investment vehicle you choose, it’s important to carefully evaluate the risks and potential rewards before investing. And while earning a higher interest rate on your savings can be a useful strategy for profiting from rising interest rates, it’s important to ensure that your investment strategy aligns with your overall financial goals and risk tolerance. Investing in Real Estate Investment Trusts (REITs) can be a smart strategy for profiting from rising interest rates.

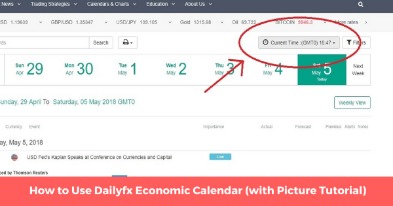

Economic Calendar

On the other hand, let’s say the Fed raises interest rates just enough and creates a soft landing that brings down the rate of inflation. It doesn’t have to have restrictive monetary policy of extremely high interest rates, so it decides to lower. Those two scenarios have different implications for stocks and investing.

- That usually means that borrowers have an easier time making loan payments and banks have fewer non-performing assets.

- Its now-popular FICO scores help determine not just whether someone qualifies for a credit card or a mortgage or auto loan, but how much interest they will pay.

- The index generated 10-year annualized returns of 14.19%, with calendar year returns as high as 37% in 2017.

- Moreover, its financial position ratios are not significantly correlated with economic and financial cycles.

- Those who want to take advantage of the environment could consider stocks in the relevant sectors listed in this article.

- These companies usually invest in safe, reliable bonds to earn steady income that backs the insurance policies that they write.

The financial sector has historically been among the most sensitive to changes in interest rates. With profit margins that actually expand as rates climb, entities like banks, insurance companies, brokerage firms, and money managers generally benefit from higher interest rates. The COVID-19 pandemic had a pronounced, depressive effect on global financial markets. The deep uncertainty about economic activity led to the Federal Reserve slashing the federal funds rate to a range of 0% to 0.25%.

Which sectors and stocks perform well when rates rise?

One way to take advantage of these higher rates is to shop around for the best deals. Many online banks and credit unions offer competitive rates on savings accounts and CDs, often with lower fees than traditional brick-and-mortar banks. Additionally, some financial institutions offer promotional rates or bonuses for new account holders, which can provide even higher returns. However, investing in commodities and natural resources also comes with its own risks, such as volatility and fluctuations in supply and demand.

The second half of February brought not just a market selloff, but also indications of a more serious potential shift in market outlook. Just two weeks after hitting a high of 3948 on Feb 16, the S&P 500, the benchmark index of the broader https://g-markets.net/helpful-articles/how-to-be-a-profitable-forex-trader/ U.S. market, has fallen 3.5%, while the tech-and-growth-stock-heavy Nasdaq index is down about 6.4%. For some, that may seem like the kind of moderate dip that could be a buying opportunity, but we don’t believe that’s the case right now.

When interest rates rise, it can be a good time to consider refinancing your existing debt at a fixed rate. This can be especially attractive for those who have variable-rate debt, such as credit card balances, home equity lines of credit (HELOCs), or adjustable-rate mortgages (ARMs). To protect your investments against inflation, you may want to consider inflation-protected securities like Treasury Inflation-Protected Securities (TIPS). TIPS are government-issued bonds that are designed to keep pace with inflation, which can help protect your portfolio from the erosive effects of inflation.

Get news on sectors, like tech and energy.

NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments. I think that Charles Schwab still has quite a bit more to go in its net interest income story and its growth. There’s the short end of the yield curve and the long end of the yield curve. Charles Schwab will benefit from the rise in short-term interest rates immediately.

But now with a stronger economy and high inflation, the nation’s central bank is hitting the brakes, making things harder for stock investors and others. The Fed has already raised interest rates three times in 2023, following seven rate hikes in 2022. While Fed Chair Jerome Powell in early May indicated that the Fed may be ready to pause rate hikes at its next meeting in June, he also stated that rates will remain elevated for a period of time. According to Powell, “it would not be appropriate to cut rates and we won’t cut rates,” at least for now.5 Inflation’s growth rate slowed since mid-2022, but it continues to exceed the Fed’s target. “It’s clear that the Fed policy shift created great change in the markets,” says Bill Merz, head of capital market research at U.S. Merz notes that the Fed faces a difficult balancing act, trying to temper growth sufficiently to tamp down inflation without causing a recession.

Best Stocks for Rising Interest Rates

It is important to understand the differences, particularly when determining which service or services to select. For more information about these services and their differences, speak with your Merrill financial advisor. An additional factor creating challenges for equity markets, according to Haworth, is higher debt costs (resulting from elevated interest rates) can cut into corporate profits. “Companies that have to roll over debt in today’s market must pay more for that debt.” That opens the door, says Haworth, to the potential for reduced corporate earnings going forward. We sell different types of products and services to both investment professionals and individual investors.

Even though you are striving to make smart purchases, you must use caution. However, you can still use some of these ideas when constructing your portfolio to help you diversify. “The US economy continues to run hot – the labour market is extremely tight and a number of executives we spoke to described their challenges in retaining staff and preventing competitors from poaching talent. Industrial companies in particular continue to see record backlogs, with the easing of logistics and supply chain constraints only just starting to have an impact on deliveries and lead times.

Explore business banking

And aside from the competitive advantage of its specific operations, rising interest rates generally means rising returns on firms sitting on a lot of capital. That naturally makes AMG one of the best stocks for rising interest rates. Not surprisingly, shares have rallied 40% or so in the last six months, versus a 1.5% return for the S&P 500.